CORRECTING and REPLACING PHOTO Rent-A-Center, Inc. Highlights How Engaged Capital is Seeking to Advance Its Own Interests at the Expense of All Other Stockholders

Engaged Capital Has Proposed No Plan Aside From Running a Self-Serving and Value Destructive Sale Process

Urges Stockholders to Protect Their Investment by Voting “FOR” Each of Rent-A-Center’s Highly Qualified Director Nominees on the WHITE Proxy Card

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170522005424/en/

The release reads:

Engaged Capital Has Proposed No Plan Aside From Running a Self-Serving and Value Destructive Sale Process

Urges Stockholders to Protect Their Investment by Voting “FOR” Each of Rent-A-Center’s Highly Qualified Director Nominees on the WHITE Proxy Card

The Rent-A-Center Board unanimously recommends stockholders vote the WHITE

proxy card “FOR” the Company’s

highly-qualified and experienced director nominees:

Rent-A-Center’s letter to stockholders and other materials regarding the Board's recommendation for the 2017 Annual Meeting of Stockholders can be found at http://investor.rentacenter.com.

The full text of the letter is below:

TIME IS SHORT!

VOTE “FOR” THE EXECUTION OF THE BOARD’S

STRATEGIC PLAN AND “FOR” YOUR BOARD’S NOMINEES ON THE WHITE CARD TODAY –

BY SIGNING, DATING AND RETURNING THE WHITE PROXY CARD IN THE

POSTAGE-PAID ENVELOPE PROVIDED

Dear Rent-A-Center Stockholder,

We are less than three weeks away from the 2017 Rent-A-Center Annual

Meeting of Stockholders, on

In seeking representation on the Rent-A-Center Board,

Notwithstanding Engaged Capital’s short-term time horizon and interest,

the Rent-A-Center Board and management team have held extensive

discussions with

We urge you to protect the value of your investment in

ENGAGED CAPITAL: SHORT-TERM FOCUS AND HISTORY OF STOCKHOLDER VALUE DESTRUCTION

-

Short-term investor:

Engaged Capital exited its ten most recent activist campaigns after an average holding period of only ~13 months.1 -

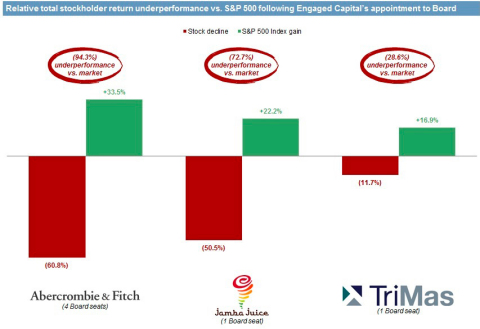

Consistent value destruction: Companies at which

Engaged Capital has secured a Board seat have underperformed theS&P 500 index by an average of 7.8% from the time of Engaged Capital’s new director appointments. Excluding those companies that were sold subsequent to Engaged Capital’s new director appointments, underperformance relative to theS&P 500 was an average of 20.7%.2

The accompanying chart illustrates outcomes for stockholders in three

situations in which

In short,

ENGAGED CAPITAL HAS DEMONSTRATED ZERO UNDERSTANDING OF

RENT-A-CENTER’S BUSINESS

AND HAS OFFERED NO PLAN BEYOND

RUNNING A SELF-SERVING SALE PROCESS

The Rent-A-Center Board of Directors takes its fiduciary responsibilities to stockholders seriously. The Board regularly reviews the Company’s strategic priorities and opportunities, and assesses them against a variety of strategic options. Everything we do is in the context of creating value for ALL of our stockholders.

The Rent-A-Center Board thoroughly reviewed Engaged Capital’s single,

self-serving suggestion of immediately launching an opportunistic sale

process. The Board determined that continuing to execute on our

strategic plan will deliver substantially more value to all stockholders

than conducting a sale process at this time, which will only transfer

that upside to any potential buyers. Aside from an outright sale of the

Company,

|

Rent-A-Center Board and Management |

Engaged Capital: No Operating Plan, No Ideas, No Strategy |

|||

|

√ Rent-A-Center has a comprehensive turnaround plan carefully designed to grow and improve all segments of the business |

x Engaged Capital has not demonstrated an understanding of Rent-A-Center’s business, the rent-to-own industry or the attractive stockholder value potential embedded in our strategic plan |

|||

|

√ Plan was developed via a thoughtful and thorough process with input from the entire Board and senior management team |

x Engaged Capital has offered no view on an operating strategy |

|||

|

√ Plan includes specific, highly-actionable items the Company has and will continue to pursue in each of its segments to turn the business around and drive value for all stockholders |

x Engaged Capital’s only proposal is to sell the Company now to benefit itself, while shares are trading near multi-year lows |

|||

|

√ Strategic plan has already produced positive results and is being overseen by an experienced, independent and diverse Board that is committed to driving change and progress |

x Selling the Company today would deprive existing stockholders of the significant upside embedded in the Board’s strategic plan |

|||

We believe that voting for Engaged Capital’s nominees is a vote for

value destruction and would usurp the opportunity for

PROTECT THE VALUE OF YOUR INVESTMENT – VOTE THE ENCLOSED WHITE PROXY CARD TODAY

In order to preserve the value of your investment and ensure the Company

continues to execute on its strategic plan, it is important to support

the Rent-A-Center Board’s compelling slate of nominees. Engaged

Capital’s nominees will answer to only one stockholder and blindly

pursue its agenda to immediately run an opportunistic sale process,

despite how value destructive it may be for our stockholders other than

Your Board unanimously recommends that stockholders vote “FOR”

Rent-A-Center’s three highly-qualified candidates –

We urge you to protect the value of your investment and disregard

Engaged Capital’s self-serving campaign by simply discarding any blue

proxy card that you may receive from

Thank you for your continued support.

The Rent-A-Center Board of Directors:

|

Mark E. Speese |

Michael J. Gade |

Jeffery M. Jackson |

|||||||||||||||||||

|

J.V. Lentell |

Steven L. Pepper |

Leonard H. Roberts |

Rishi Garg |

||||||||||||||||||

If you have any questions, or need assistance voting your WHITE proxy card, please contact:

1212 Avenue of the

Telephone: (212) 297-0720

Toll-Free:

(877) 259-6290

Email: Info@okapipartners.com

About

A rent-to-own industry leader,

Forward-Looking Statements

This press release and the guidance above contain forward-looking

statements that involve risks and uncertainties. Such forward-looking

statements generally can be identified by the use of forward-looking

terminology such as "may," "will," "expect," "intend," "could,"

"estimate," "should," "anticipate," "believe," or “confident,” or the

negative thereof or variations thereon or similar terminology. The

Company believes that the expectations reflected in such forward-looking

statements are accurate. However, there can be no assurance that such

expectations will occur. The Company's actual future performance could

differ materially from such statements. Factors that could cause or

contribute to such differences include, but are not limited to: the

general strength of the economy and other economic conditions affecting

consumer preferences and spending; factors affecting the disposable

income available to the Company's current and potential customers;

changes in the unemployment rate; difficulties encountered in improving

the financial and operational performance of the Company's business

segments; the Company’s chief executive officer and chief financial

officer transitions, including the Company’s ability to effectively

operate and execute its strategies during the interim period and

difficulties or delays in identifying and/or attracting a permanent

chief financial officer with the required level of experience and

expertise; failure to manage the Company's store labor and other store

expenses; the Company’s ability to develop and successfully execute

strategic initiatives; disruptions, including capacity-related outages,

caused by the implementation and operation of the Company's new store

information management system, and its transition to more-readily

scalable, “cloud-based” solutions; the Company's ability to develop and

successfully implement digital or E-commerce capabilities, including

mobile applications; disruptions in the Company's supply chain;

limitations of, or disruptions in, the Company's distribution network;

rapid inflation or deflation in the prices of the Company's products;

the Company's ability to execute and the effectiveness of a store

consolidation, including the Company's ability to retain the revenue

from customer accounts merged into another store location as a result of

a store consolidation; the Company's available cash flow; the Company's

ability to identify and successfully market products and services that

appeal to its customer demographic; consumer preferences and perceptions

of the Company's brand; uncertainties regarding the ability to open new

locations; the Company's ability to acquire additional stores or

customer accounts on favorable terms; the Company's ability to control

costs and increase profitability; the Company's ability to retain the

revenue associated with acquired customer accounts and enhance the

performance of acquired stores; the Company's ability to enter into new

and collect on its rental or lease purchase agreements; the passage of

legislation adversely affecting the Rent-to-Own industry; the Company's

compliance with applicable statutes or regulations governing its

transactions; changes in interest rates; adverse changes in the economic

conditions of the industries, countries or markets that the Company

serves; information technology and data security costs; the impact of

any breaches in data security or other disturbances to the Company's

information technology and other networks and the Company's ability to

protect the integrity and security of individually identifiable data of

its customers and employees; changes in the Company's stock price, the

number of shares of common stock that it may or may not repurchase, and

future dividends, if any; changes in estimates relating to

self-insurance liabilities and income tax and litigation reserves;

changes in the Company's effective tax rate; fluctuations in foreign

currency exchange rates; the Company's ability to maintain an effective

system of internal controls; the resolution of the Company's litigation;

and the other risks detailed from time to time in the Company's

Additional Information and Where to Find It

The Company, its directors, executive officers and other employees may

be deemed to be participants in the solicitation of proxies from the

Company’s stockholders in connection with the matters to be considered

at Rent-A-Center’s 2017 Annual Meeting. On

1 Uses stake at 13F reporting dates to determine ownership;

campaigns at:

2

Calculated as total compound stockholder return from time of Engaged

nominee appointment through the present (or, in the case of a sale,

through the closing date), including dividend reinvestment.

3

Source: Company filings, FactSet, as of 5/17/17. Data runs from date

4

These investment illustrations do not capture the possible corporate

governance risks that may arise if Engaged Capital’s nominees are

elected to the Rent‐A‐Center Board. For example,

View source version on businesswire.com: http://www.businesswire.com/news/home/20170522005424/en/

Source:

Investors:

Maureen Short, 972-801-1899

Interim Chief

Financial Officer

maureen.short@rentacenter.com

or

Okapi

Partners LLC

Bruce H. Goldfarb / Chuck Garske / Teresa Huang

212-297-0720

or

Media:

Joele

Frank, Wilkinson Brimmer Katcher

Kelly Sullivan / James Golden /

Matthew Gross

212-355-4449